Executive Summary

Asia’s growing importance in global capital markets is no longer confined to emerging-market cycles or post-pandemic rebounds. Record trade surpluses, outwards capital deployment, and deepening equity markets, led by China and India, are reshaping global capital flows and positioning Asia at the center of capital formation in 2026.¹ ⁴

Key Takeaways

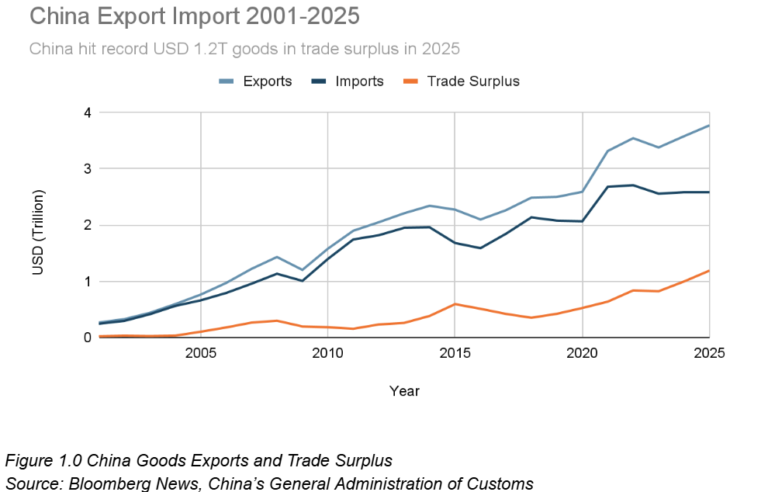

- China recorded a USD 1.2 trillion surplus in 2025, reinforcing its role as a global capital exporter rather than a reserve accumulator.¹

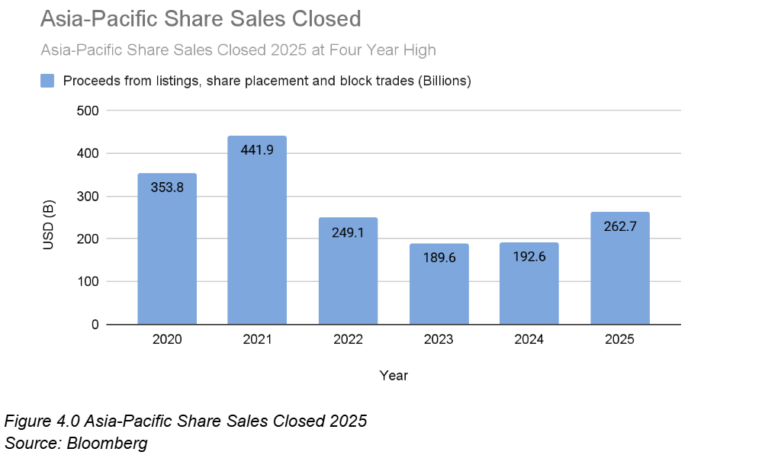

- Asia Pacific equity markets raised USD 262.7 billion, the highest level in four years.²

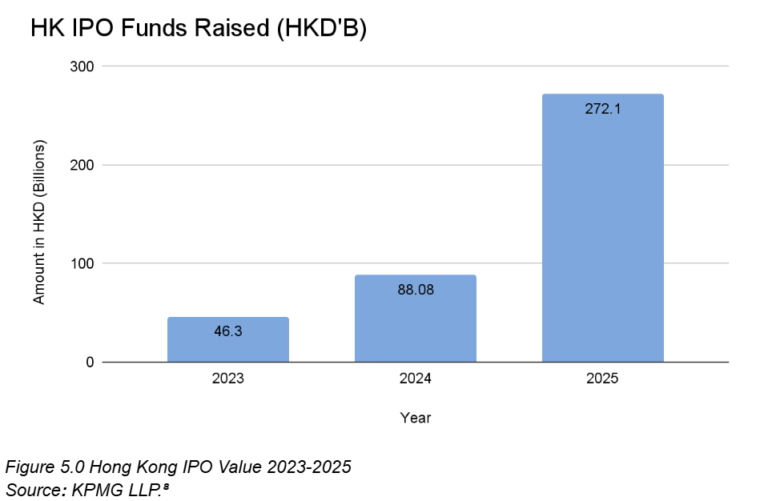

- Hong Kong and India are emerging as core global IPO hubs, not regional venues.²

- Global capital flows are reordering, with the United States increasingly pulling capital inwards while China deploys capital overseas.³

- The redistribution of China’s foreign assets from the state to the private sector is creating a new source of global liquidity and volatility.⁴

China’s Export Engine is Far From Over

China closed 2025 with a record goods trade surplus of USD 1.2 trillion defying the expectations that tariffs, geopolitical tensions, and weak domestic demand would materially slow export growth.¹

Exports accelerated toward year end was supported by:

- Diversification away from the US market

- Rising shipments to Southeast Asia and Europe

- A decisive move up the value chain into semiconductors, electric vehicles, batteries, ships, and industrial machinery.¹

The IMF estimates that China’s current-account surplus is at 3.3% of GDP, its highest level since 2010.⁵ Yet the surplus also reflects a deeper structural tension. China’s manufacturing engine remains globally competitive, while domestic consumption lags, reinforcing vulnerabilities that are likely to persist into this year and beyond.

From Trade Surplus to Capital Export

China’s swelling trade surplus is no longer recycled primarily into foreign-exchange reserves or US treasuries. Instead, surplus capital is increasingly deployed by companies, individuals, and state-linked financial institutions into overseas securities and assets, marking a structural break from past cycles.⁴

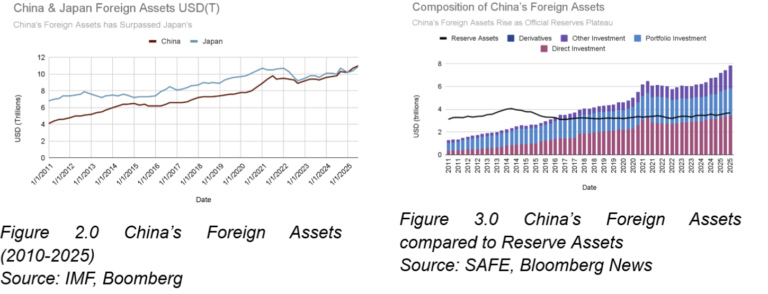

As can be seen in Figure 2.0 the chart illustrates a structural turning point in global capital markets: China’s total foreign asset holdings have now overtaken those of Japan, long regarded as the world’s archetypal surplus economy and largest net creditor. While Japan’s foreign assets have grown steadily over the past decade, China’s accumulation has accelerated sharply since the late 2010s, driven not only by official reserves but—crucially—by non-reserve, private-sector foreign assets. Following this, in early 2025, China’s outbound investment overtook that of the United States, accounting for roughly 10% of global outbound foreign direct investment, according to OECD data.⁶

Investors compromising China’s non-official sector saw their holdings of assets abroad soar by more than $1 trillion in the first three quarters of last year as can be seen in figure 3.0. Increased autonomy over capital deployment is enabling Chinese institutions to integrate more firmly into the underlying mechanics of global financial markets, strengthening their insulation from sanctions while simultaneously raising the complexity of regulatory oversight in Western jurisdictions.

This represents a structural shift in global capital markets:

- China has re-emerged as a net exporter of capital

- Outbound Chinese investment has overtaken US outbound Investment

- Greenfield projects now dominate overseas investment activity.³ ⁶

Asia’s Equity Capital Markets Take Center Stage

Asia’s expanding role in global trade and capital deployment is directly reflected in its equity markets.

As can be seen from figure 4.0 below, the figure highlights a clear inflection point in Asia-Pacific equity capital markets. After contracting materially from the 2021 peak, share sales across the region recovered decisively in 2025, reaching a four-year high.

Total proceeds raised via IPOs, share placements, and block trades climbed to approximately USD 260 billion, reversing two consecutive years of subdued activity.² This rebound underscores that Asia’s equity markets are not merely recovering from a cyclical downturn, but are reasserting themselves as globally relevant capital-raising venues.

Hong Kong’s sharp rebound as an offshore listing hub for Chinese firms and India’s second consecutive year of record IPOs were the primary drivers of this surge.

In 2025:

- $262.7 billion was raised across Asia-Pacific via IPOs, placements, and block trades

- The region recorded its highest equity issuance in four years

- Four of the world’s five busiest equity deal venues were in Asia²

Hong Kong’s sharp rebound and India’s record IPO activity were the primary drivers.²

2026: A Blockbuster Equity Pipeline

On the equity capital markets front, Hong Kong’s revival is expected to persist, with Chinese companies continuing to pursue listings and secondary offerings in the city.9 As can be seen from figure 5.0 below Hong Kong reclaimed the top global ranking by IPO funds raised in 2025, with total proceeds reaching HKD 272.1 billion, representing a 210% increase year-on-year. This sharp acceleration marks a decisive reversal from the subdued post-2021 period and places Hong Kong firmly back among the world’s most important equity financing hubs.9

Importantly, the recovery was not driven solely by a small number of outsized transactions. A total of 100 IPOs were completed in 2025, up 43% versus 2024, indicating a meaningful expansion in market breadth and issuer confidence.9 This reinforces Hong Kong’s position as the primary offshore equity gateway for China.

Momentum is expected to extend into 2026.

- Hong Kong IPOs may raise up to USD 45 billion, the city’s largest annual total in six years.⁸

- India is on track for a third consecutive year of record IPO activity, supported by digital platforms, financial services firms, and multinational carve-outs.²

India is poised for another strong year of IPO activity, though Citi expects fewer deals with larger average transaction sizes, anchored by strong local institutional and retail demand. Multinational corporations are also expected to continue monetizing their Indian subsidiaries, reflecting India’s maturation as a core capital market.9

Beyond China and India, Japan and Australia are likely to see increased deal activity, supported by corporate governance reforms, balance sheet strength, and strategic repositioning. Citi also notes that Southeast Asia is set to see more ECM transactions, particularly as regional champions access public markets to fund growth and consolidation.9

Asia is evolving from a growth-oriented equity market into a globally significant capital-raising hub.

A Reordering of Global Capital Flows

While Asia’s markets deepen, the United States is increasingly focused on absorbing capital domestically through tariffs, subsidies, and industrial policy.³

The result is a bifurcated global system:

- The US as a capital magnet

- China as a capital exporter

- Asia as the primary arena where trade, capital, and industrial policy intersect³

For investors, Asia is no longer an “emerging markets allocation.” It is becoming a core pillar of global portfolios.

Conclusion

Asia’s role in global capital markets has shifted from cyclical participation to structural leadership. Persistent trade surpluses, outward capital deployment, and deeper capital markets are reordering global capital flows.

China sits at the center of this transition. Trade surpluses are no longer absorbed by official reserves but dispersed globally through corporates and private investors, positioning China as a growing source of global liquidity and increasing market sensitivity to Chinese capital and currency dynamics.

At the same time, Asia’s equity markets—led by Hong Kong and India—are shaping global capital formation, supported by a forward pipeline defined by scale, quality, and institutional participation rather than short-term momentum.

Together, these forces mark a durable shift. Asia is no longer a peripheral allocation but a core anchor of global capital strategy.

Footnotes

¹ Bloomberg News, “China’s Export Boom Far From Over After Record Trade Surplus,” January 14, 2026, updated January 15, 2026.

² Bloomberg News, “Asia’s Equity Capital Markets Set for Blockbuster 2026 After Share Sale Surge,” January 2026.

³ Bloomberg News, “US and China Flip the Global Script as Capital Flows Reverse,” January 12, 2026.

⁴ Bloomberg News, “China’s $1.2 Trillion Windfall Quietly Seeps Into Global Markets,” January 16, 2026.

⁵ International Monetary Fund, World Economic Outlook: Navigating Global Divergences (Washington, DC: International Monetary Fund, 2025).

⁶ Organisation for Economic Co-operation and Development, FDI in Figures and Global Investment Trends (Paris: OECD, 2025).

⁷ Bloomberg Economics, commentary cited in Bloomberg News, January 2026.

⁸ KPMG LLP, Hong Kong Capital Markets Outlook 2026 (Hong Kong: KPMG, 2025).

9 Citigroup Inc. “China’s Reawakening Puts Asia M&A on Confident Course for 2026.” Bloomberg News. January 7, 2026.

Bibliography

-

Bloomberg News. “China’s Export Boom Far From Over After Record Trade Surplus.” January 14, 2026. Updated January 15, 2026.

-

Bloomberg News. “Asia’s Equity Capital Markets Set for Blockbuster 2026 After Share Sale Surge.” January 2026.

-

Bloomberg News. “US and China Flip the Global Script as Capital Flows Reverse.” January 12, 2026.

-

Bloomberg News. “China’s $1.2 Trillion Windfall Quietly Seeps Into Global Markets.” January 16, 2026.

-

International Monetary Fund. World Economic Outlook: Navigating Global Divergences. Washington, DC: IMF, 2025.

-

Organisation for Economic Co-operation and Development. FDI in Figures and Global Investment Trends. Paris: OECD, 2025.

-

Bloomberg Economics. Commentary cited in Bloomberg News. January 2026.

-

KPMG LLP. Hong Kong Capital Markets Outlook 2026. Hong Kong: KPMG, 2025.

-

Bloomberg News.Citigroup Inc. “China’s Reawakening Puts Asia M&A on Confident Course for 2026.” January 7, 2026.