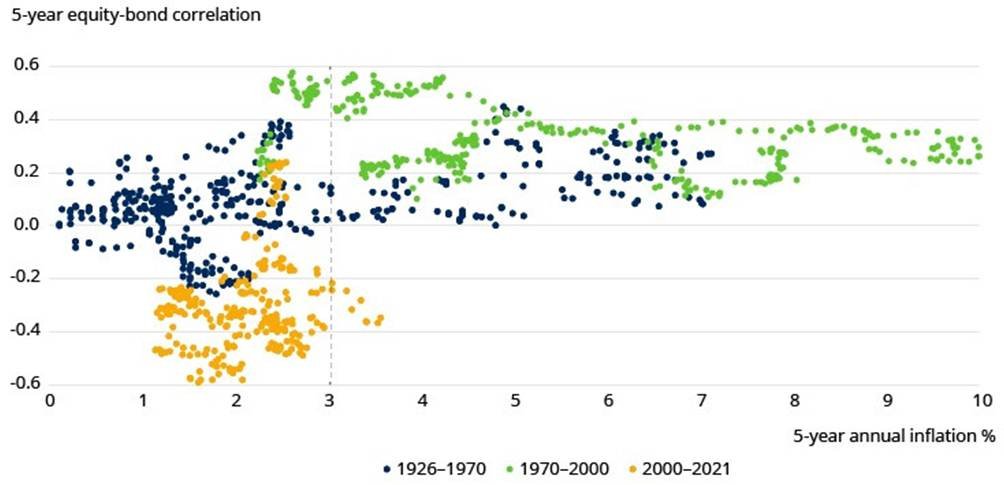

In the past two decades, bonds are commonly assumed to be negatively correlated to equities. As such, they are used as a hedge to provide stability in portfolios. This assumption shaped how investors understood as defensive investing in the past recent years.

However, the negative equity-bond correlation is a relatively recent phenomenon, existing under very specific macro environments.

Negative Equity-Bond Correlation: A Relatively Recent Phenomenon

Source: CFA Institute, Datastream Refinitiv and Schroders; Schroders – Why is there a negative correlation between equities and bonds, 2 July 2022

Under high inflation expectations and rising interest rates, the negative correlation between equities and bonds broke down, leading to both asset classes declining simultaneously in 2022.

The decline of bonds as a reliable hedge against equities downturns means long-horizon investors cannot depend on the equity-bond negative correlation for built-in portfolio resilience.

This necessitates a shift in portfolio construction toward broader diversification and reassessment of risk management strategies.

What has Changed

The successful track-record of utilising bonds as a hedge hinged on a very specific set of macro conditions:

- Anchored and low inflation expectations

- Declining interest rates

- Credible central bank independence

Persistent high Inflation Associated with Positive Equity-Bond Correlations

Source: CFA Institute, Datastream Refinitiv and Schroders, data to 31 Dec 2021; Schroders – Why is there a negative correlation between equities and bonds, 2 July 2022

However, these conditions are far less from certain in today’s environment. Years of fiscal deficits, spiralling debt, inflationary pressures, and increasing geopolitical uncertainties have introduced a renewed possibility: simultaneous losses in both bonds and equities.

Implications for Long-Horizon Investors

- Increased Portfolio Volatility and Risk: When correlation between equities and bonds turns positive, both asset classes may decline simultaneously. This increases the overall risk and potential for deeper drawdowns.

- Revisiting Asset Correlation Assumptions: Modern portfolio theory relies heavily on low or negative correlations for diversification benefits. Investors need to challenge their assumptions on how different assets will behave during market stress.

- Need for New Diversifiers: With the hedging ability of bonds questioned, investors should seek alternative sources of diversification to manage risk.

How Institutions have Responded

This does not mean investors should abandon bonds, rather their purposes needs to be crystalised:

- Liquidity management

- Income and yield generation

- Capital preservation

Investors should not expect bonds to independently offset equity drawdowns. Instead, investors need to broaden their defensive toolkit to include:

- Real assets such as real estate, infrastructure and commodities

- Absolute-return strategies designed to perform across regimes

- Private markets

Long-horizon investors must recognise that no single asset can hedge every environment.

Key takeaway

Bonds still matter — but relying on them as the sole defensive anchor is unwise. Robust portfolios today require multi-hedge architectures designed for inflation uncertainties.

#MacroOutlook #GlobalMarkets #AssetAllocation #FamilyOffice #AssetManagement #FTCPInsights