Geopolitics shapes prices, capital flows, growth dynamics, structural changes and risk premia. Recent events in Venezuela, Iran, the Federal Reserve as well as Davos on concerns for Greenland can have wide reaching – even long-lasting – serious consequences globally. Investment returns are thus naturally sensitive to geopolitical risks at broad market, sector, factor, country and asset levels.

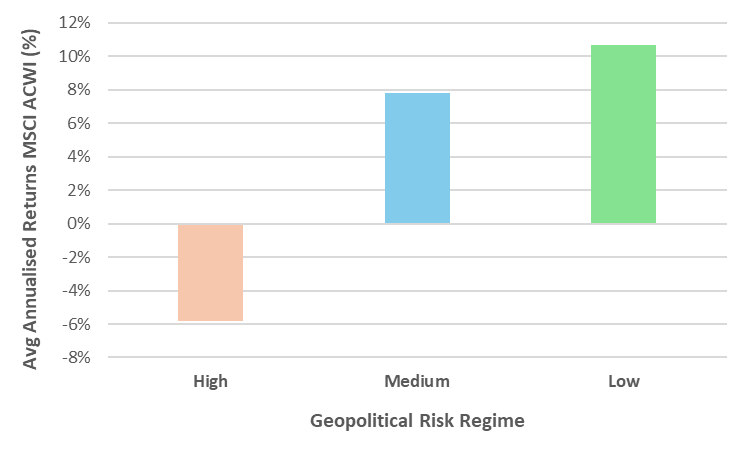

As expected, high geopolitical risk is associated with lower returns.

Source: MSCI Blog Post: Understanding Geopolitical Risks in Investments

The next 20 years will be defined not by cyclical forces, but by structural shifts in geopolitics that will fundamentally reshape global returns.

1. The World Is Entering a Multi-Polar Era

For decades, by relying on rule-based conduct of business, the US-led global order has enabled:

- Stable and growing trade

- Predictable supply chains, emphasising on efficiency

- Deep capital markets, with free flow of capital

- Increased connectivity of human capital, ideas and innovation

That era is ending.

We are now in a world defined by US-China bifurcation, with Europe, India, Southeast Asia, and the Middle East forming strategic balancing blocs.

This shift materially impacts:

- Supply chain

- Currency regimes

- Technology competition

- Energy security

- Capital mobility

- Global coordination such as climate change and future pandemic outbreaks

For family offices, this means geographic diversification is no longer optional — it is mandatory.

2. Deglobalisation Towards Regionalisation

Deglobalisation does not mean the end of global trade; it is the rise of regionalisation:

- USA reshoring of manufacturing and services

- China tech bifurcation and economic diversification

- Europe strengthening its strategic autonomy

- Southeast Asia supply-chain relocation

- India’s rise as a manufacturing hub

Institutional investors are re-allocating toward:

- Domestic infrastructure

- Localised manufacturing assets

- Regionally diversified supply-chain

These shifts create opportunities in private credit, logistics assets, and infrastructure equity.

Notably, China’s Belt and Road Initiative (BRI) has shown prescience in building extensive infrastructure projects, energy networks, and digital infrastructure over the past decade, providing investors now a draft blueprint as a guide.

3. Energy Security Reshapes Investment Cycles

Reliance on fossil fuel is decreasing, and renewables are on the inadvertent upward trend, further highlighting the importance of critical mineral vital for the energy transition.

Against this backdrop, the way traditional oil producers pivot, the stark differences in processing competencies of critical mineral of various countries and the ability of existing grid of countries to handle rising demand all come into the forefront.

This energy transition is no longer just an environmental story; it is a geopolitical investment cycle.

- Oil exporters shifting capital

- Renewables scaling at unprecedented cost curves

- Grid modernisation gaining urgency

- Rare and critical minerals asset owners and downstream processing becoming strategic

Likely winners will be:

- Energy infrastructure

- Transmission networks

- Mineral/commodity-linked assets, especially rare, critical minerals

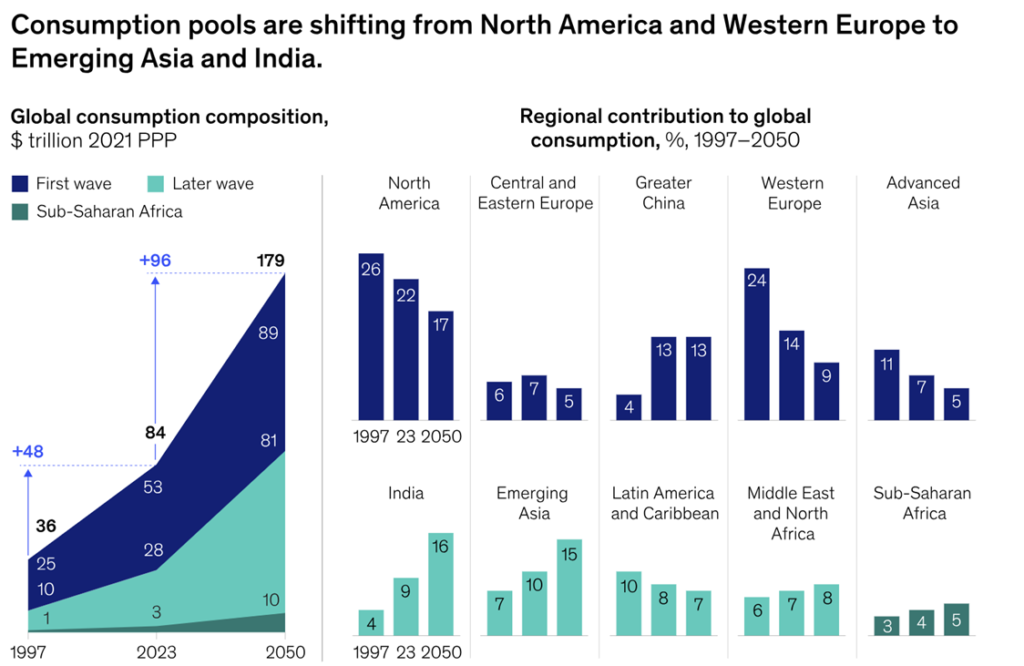

4. Demographics Will Dictate Growth and Return Profiles

Demographics, such as age structure and population growth, profoundly shape economic growth. It can be divided into 2 groups, namely: young and growing vs aging economies.

This divergence is structural and will have material impact on demand and supply, as well as prices for decades.

Source: McKinsey & Company – Confronting the Consequences of a New Demographic Reality, 14 Jan 2025

Regions with aging populations such as China, South Korea, Japan and many European countries will face:

- Lower productivity

- Higher dependency burdens

- Slower equity return potential

On the other hand, regions with favourable demographics such as India, Indonesia, Vietnam and the Philippines with “demographic dividend” will create:

- Larger consumer markets

- Higher potential growth multiples

- Stronger potential domestic equity outperformance

Investors need to be cognisant of these demographic trends and their inevitable impact on growth and investment returns.

5. Capital Controls, Sanctions & Currency Risks Will Matter More

Family offices must plan for:

- More capital-control regimes

- Barrier to cross-border investment flows

- Volatile FX cycles

- Fragmented payment systems

Institutional portfolios can hedge this by diversifying across:

- Hard-currency assets

- Multi-currency debt portfolios

- Global supply-chain infrastructure

- Cross-border private markets

6. The Institutional Response: Build Geopolitical Resilience

It is not possible to predict geopolitical events, and Institutions should not attempt to do that. Instead, Institutions can prepare for geopolitical uncertainties by building resilience into the portfolio:

- Allocating across multiple macro regimes and reduce single-country risks

- Building redundant sources of return and income by increasing structural diversifiers

- Stress-testing for shifts over different timeframes, and to hold liquidity that can deploy during shocks

- Adopting scenario-based allocation and building multi-regional investment pipelines

Key Takeaway

The next 20 years will not reward passive, home-biased portfolios. It will reward institutional-grade, geopolitically aware capital allocation — built to survive geopolitical changes, not just market cycles.

#MacroOutlook #GlobalMarkets #AssetAllocation #FamilyOffice #AssetManagement #FTCPInsights