Markowitz’s Modern Portfolio Theory showed how effective diversification is, and has a tremendous impact on how institutions construct modern portfolios, including the 60/40.

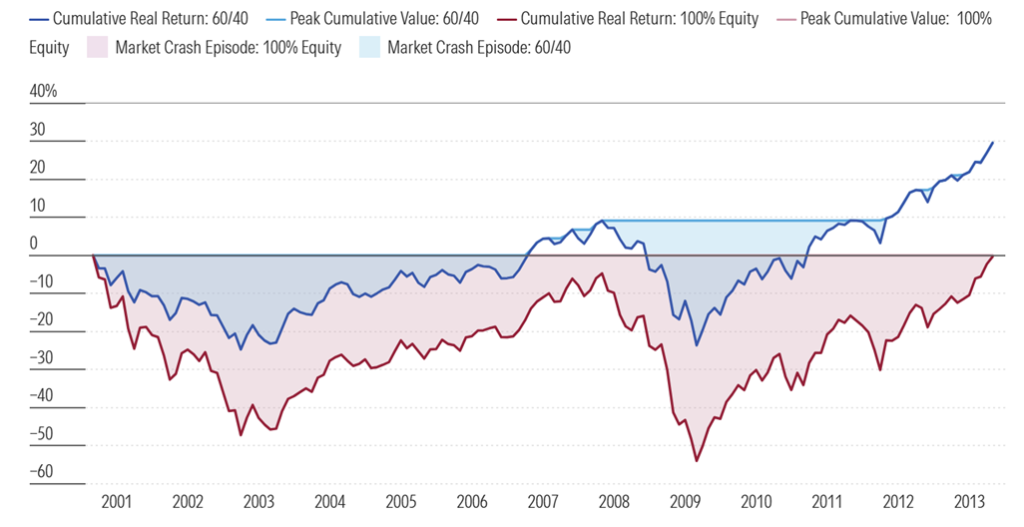

This framework has shown to be particularly effective during the Lost Decade (2000 – 2013), when returns for 60/40 portfolios far outpaced that of 100% equities.

Comparative Returns: 2000 – 2013

Source: Morningstar – The 60/40 Portfolio: A 150-Year Markets Stress Test, 2 Dec 2025

However, the debate if the 60/40 portfolio is outdated resurfaces every few years, usually after a difficult period for both equities and bonds.

How 60/40 can Work

The 60/40 portfolio thrives under a unique set of conditions:

- Stable inflation

- Falling interest rates

- Predictable economic cycles

- Negative equity-bond correlation

Together, these forces produce diversification benefits that smoothed volatility and supports compounding.

Those conditions are no longer guaranteed. That will result in 60/40 portfolios struggling.

The Hidden Concentration Problem

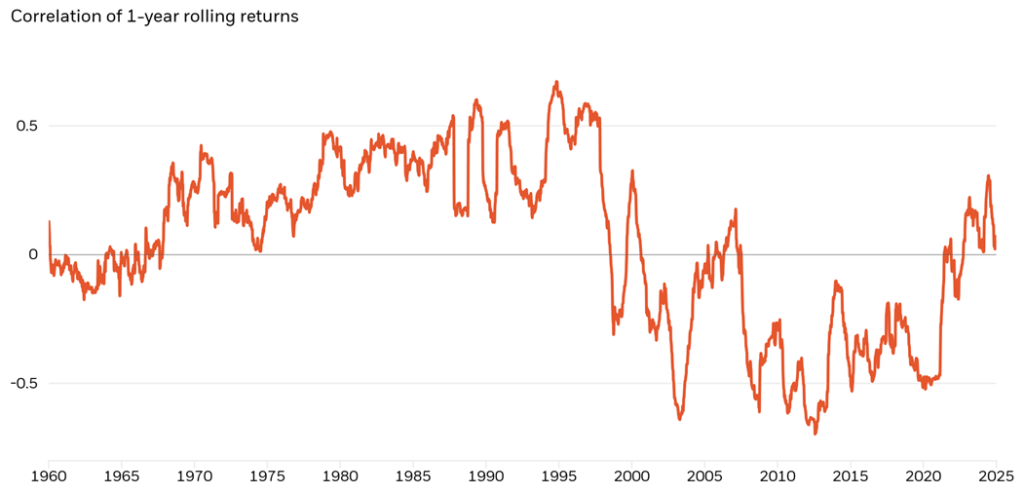

In periods of macro-stress, when the necessary conditions shift, equities-bonds can become positively correlated, undermining the very diversification investors expect. This led to the simultaneous decline of both equities and bond in 2022.

Equities-Bond Correlations Show Diminished 60/40 Portfolio Diversification

Source: BlackRock – Rebuilding Resilience in 60/40 Portfolio, 13 Mar 2025

Approaching 60/40 Today

Although the 60/40 portfolio’s most recent bear market lasted longer than the equity market’s most recent bear market did, it never reached a deeper decline.

The 60/40 portfolio has softened the blow of nearly every market crash. While bonds stayed in a bear market for a full 40 years in the mid-20th century, 60/40 portfolios recovered from various downturns and went on to new highs.

We cannot predict how long it takes for markets to recover, nor when the next crash will happen. Therefore, diversification is still the best way to navigate market uncertainties in both the equity and bond markets, while staying invested for the long term.

As such, institutional investors should still reference 60/40 — but as a starting framework, not an end solution by adapting it:

- Adding real assets for inflation protection

- Incorporating private credit for contractual income

- Using absolute-return strategies to manage drawdowns

- Diversifying across currencies and regions

This is not a rejection of 60/40, but an evolution into a risk-balanced, regime-aware portfolio.

Key Takeaway

60/40 is not dead — but it is incomplete. No strategy on its own is. The portfolios that succeed will be those that retain its discipline while expanding beyond its limitations to reflect today’s more complex risk environment.

#MacroOutlook #GlobalMarkets #AssetAllocation #FamilyOffice #AssetManagement #FTCPInsights