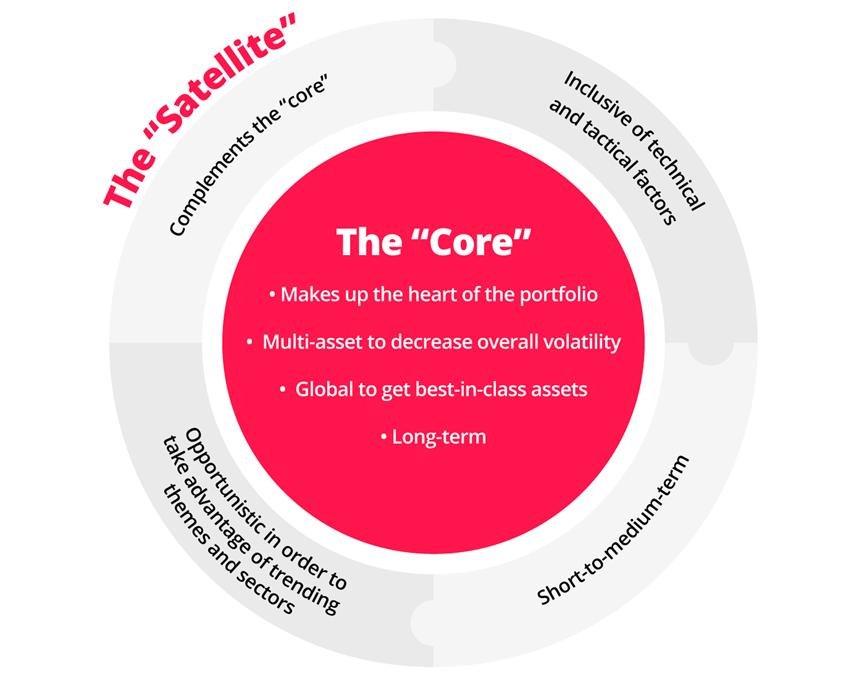

The rapid rate of globalisation over the past few decades has given rise to the core-satellite model: broad global beta at the core, alpha-seeking positions at the satellite. This combines stability from the core, with upside potential to outperform the market relying on the satellite.

Source: DBS Bank – What is a Core-Satellite Portfolio, 15 May 2024

However, the world has more recently witnessed a reversed trend, ie deglobalisation. Supply chains built on efficiency have since been fragmented and reshaped. With geopolitical blocs hardening, uncertainties far from over, the model too must evolve.

1. Global Beta Is No Longer One Homogeneous Exposure

Index concentration means:

- US tech dominates global indices

- China weights shrink due to geopolitical risk

- Emerging markets diverge dramatically

A single “global equity core” no longer provides diversified beta.

Institutions now build multi-core portfolios, including:

- US large-cap core

- EM ex-China core

- Asia growth core

- Global small/mid-cap core

These cores will need to be updated whenever geopolitical situations change as well. Lower weightage in China today can reverse quickly.

2. Satellites Must Reflect Macro Regimes

Satellite positions used to be tactical. Now they must be regime-aware:

- Deglobalisation plays (logistics, nearshoring)

- Energy-transition infrastructure

- Real-asset income streams

- Private credit and specialty finance

Instead of being simply used to chase alpha, satellites should also now be used to hedge macro uncertainties.

3. Fixed Income Is No Longer a Free Hedge

Duration behaves differently across regimes. Especially with inflation volatility, bonds cannot always offset equity drawdowns. This may be further intensified by currency fluctuations.

To better handle liquidity demands, institutions now use:

- Managed futures

- Global macro strategies

- Real assets

- Multi-currency fixed income

These are now part of the satellite hedging sleeve.

4. Multi-Polar World = Multi-Core Allocation

The new model:

Core = geographically diversified beta

Satellite = regime-specific alternatives

This is how institutions can manage uncertainties and maintain resilience in a world where correlations change suddenly and political shocks spill into markets.

Key Takeaway

Deglobalisation is a threat – causing inefficiencies, redundancies and reshaping global capital flows.

Family offices and investors should update their core-satellite framework with portfolios that reflect the world as it is — not as it was.

#MacroOutlook #GlobalMarkets #AssetAllocation #FamilyOffice #AssetManagement #FTCPInsights