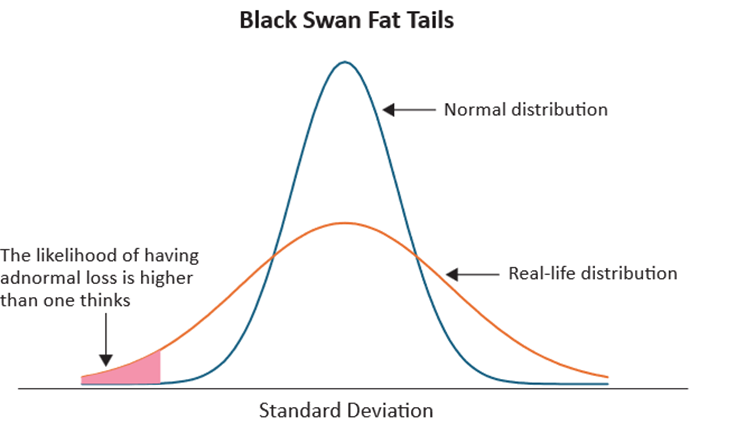

A black swan event is by definition a rare, unpredictable occurrence with a severe and widespread impact; yet in hindsight, people often rationalize, making them seem predictable in retrospect.

However, black swans are not rare – it is just that real-life distributions may simply have fatter tails than what theoretical normal distributions assume. What remains true is that they are simply unpredictable. We know for certain they will come — and often when liquidity is tight, valuations are stretched, and sentiment is complacent – just not when.

Family offices that aim to preserve wealth over generations must hence prepare for the unexpected.

1. Fragility Is the Enemy

A fragile portfolio is one where:

- A single asset class dominates returns

- Liquidity evaporates during stress

- Exposures have high positive correlation when markets fall

Families often over-allocate to real estate and public equity, the two asset classes that can crash at the same time.

2. Institutions Use Shock-Resilient Architecture

Endowments and sovereign funds achieve resilience by:

- Diversifying across time horizons

- Allocating to structural hedges like trend-following and systematic macro

- Maintaining counter-cyclical liquidity

- Stress-testing scenarios instead of relying on historical correlations

Their approach is not built on prediction but on probability and resilience.

3. Build for Survival, Not Forecasts

A black-swan-ready portfolio includes:

- 20 – 30% in diversifiers with low correlation

- 10 – 20% in income-stable real assets

- Absolute-return strategies

- Sufficient liquidity to rebalance during crises

This structure allows you to buy when others sell, which is the hallmark of long-term outperformance.

4. Liquidity Is a Strategic Asset

During crises, liquidity:

- Protects you from forced selling

- Allows you to purchase mispriced assets

- Preserves long-term compounding

Family Office with over-concentration in private assets often discover their “conservative” portfolio is highly illiquid. During a downturn when asset prices are depressed, liquidity requirements that compel any sale of assets to fund Family Office drawdowns will have a double whammy effect.

5. The Goal: Anti-Fragility

An anti-fragile portfolio:

- Limits catastrophic loss

- Benefits from volatility

- Allocates risk intentionally, not accidentally

This is how institutions survive decades of uncertainty, and how families can build wealth that lasts for generations.

#TailRisk #PortfolioResilience #WealthManagement #FamilyOffice #AssetManagement #FTCPInsights